List

Story > NEWS > Detail

[News] The Present Situation and Development Direction of China's Shared Economy

According to the 2017 survey, the trading volume of Chinese stock markets stood at about 345.2 billion yuan in 2016, up 103 percent from 2015. Among them, the share of economic transactions in key areas such as living services, production capacity, transportation, knowledge and technology, housing and accommodation, and medical care totaled 136.6 billion yuan, up 96 percent from 2015.

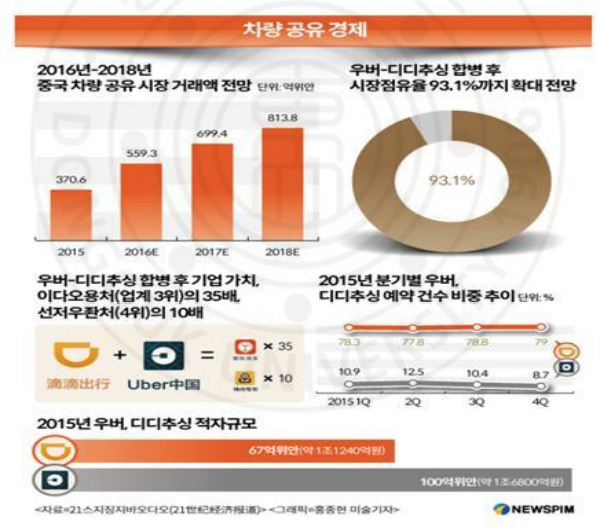

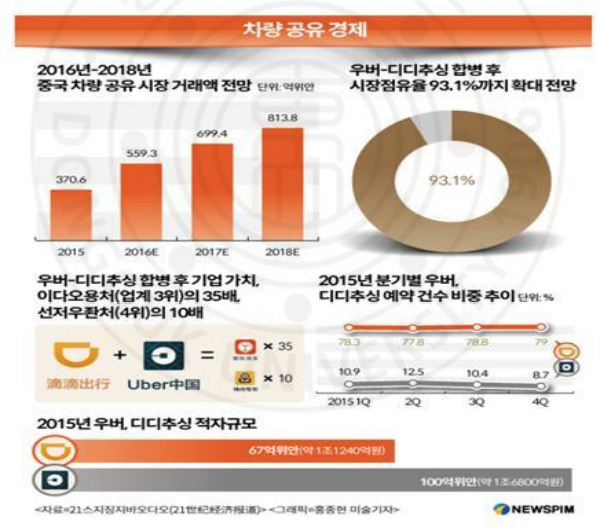

These 'shares'-related industries have shown outstanding performance in the vehicle-sharing industry. From 2016 to 2018, China's vehicle sharing market has been surging. In 2015, transactions in the Chinese vehicle-sharing market stood at 370.6 billion yuan, compared with 559.3 billion yuan in 2016. The figure stood at 669.4 billion yuan in 2017, compared with 813.8 billion yuan in 2018. The car-sharing market holds a large position in China.

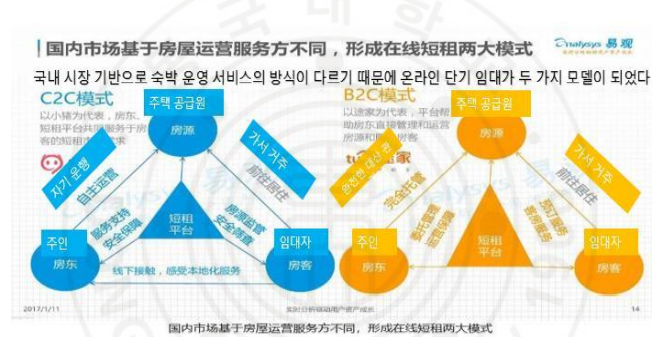

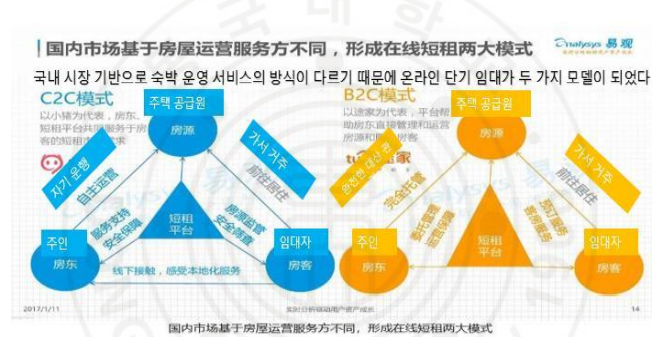

Second, accommodation sharing is the biggest growth area in China's shared economy. According to China's National Statistical Office, the number of households in China reached 1.08 in 2015. Therefore, there are numerous idle housing resources. To take advantage of these idle homes, lodging-sharing companies have received a lot of investment. Among them, Tujia and Piggy (Saojduanjou) received the most investment. In addition, Tujia purchased full ant short-term housing rents in 2016, enabling nearly five years of online short-term rental and building its own resources, channels and operational walls with the help of capital.

China has more than 10 cities and more than 2.3 million housing sources worldwide. People in China can check through Weibo or make safe payments such as Alipay. So far, Airbnb has been to provide home reservation services to overseas destinations, mainly for Chinese departures. At the same time, it is also providing home reservation services for foreign tourists coming to China. Chinese tourists, however, had little use in China's domestic market.

Currently, China has had a big impact on the pattern of competition in the industry by sharing pioneering areas such as economic development and large mergers and acquisitions in 2016. In the field of shared vehicles, in the area of merger and accommodation between Didi Travel and Uber China, Tujia acquired the ant short-term rental and apartment and bed-home businesses at Ctrip.com, Qunar.com and the business chain was expanded. The emergence of large-scale mergers and acquisitions symbolizes fast-growing accommodation sharing Despite the short time of the emerging economy, the development speed is fast and market dominance in the forefront of transportation, housing and living services has been completed early, creating an active shared atmosphere, stable user groups and sufficient market competition. This laid the foundation for the merger and acquisition of mature business models. Acquisition mergers and acquisitions in this field have emerged as a prelude to stability of competition patterns, the market structure from excessive dispersion to medium concentration, from competition to superior competition in a vicious cycle, competition from price-subsidized gold to experience improvement, and sharing of economic competition patterns for research and judgment.

I would like to add a suggestion on the development direction of China's shared economy. The shared economy has shifted from an early stage to a growth stage. First, China's shared economy is expected to maintain an average annual growth rate of more than 30 percent per year over the next five years, due to continuous acceleration of information technology innovation and applications, improving people's awareness levels and improving policies and regulations. The shared economy is expected to shift from an early stage to a growth stage. From the consumer sector to manufacturing, public services, society and life and other areas, product and service sharing areas are becoming increasingly extensive, and competition among platform companies will intensify, industry mergers and acquisitions will become more and more refined operations. The focus of competition will be shifted to improving the overall development quality of the shared economy. Second, shared economic development is expected to be increasingly standardized. In actively encouraging the sharing of economic development, the regulatory system has become a general trend of significant problems that directly affect the important interests of the public in particular. At the same time, the implementation of a multilateral collaboration governance system will be accelerated. The relevant departments are expected to actively innovate supervisory methods, using large amounts of data, cloud computing, artificial intelligence and other technologies, real-time visibility into the risks of platform enterprise market operations, funding management and user rights protection, and to innovate supervisory methods that enhance the ability to handle potential risks. Third, a shared economy is a typical credit economy with a unique characteristic of "missing" transactions among strangers. The rapid development of the shared economy has presented new requirements for social credit system construction, and by providing data and technical support for the establishment of the credit system, the two-way promotion of the economy and credit sharing system will be more prominent. The platform company can expect that a shared economy in China will be formed in the direction of guiding the use of large data technologies, user bi-directional assessments, third-party certifications, credit ratings and other means and mechanisms to improve relevant data.

According to the 2017 survey, the trading volume of Chinese stock markets stood at about 345.2 billion yuan in 2016, up 103 percent from 2015. Among them, the share of economic transactions in key areas such as living services, production capacity, transportation, knowledge and technology, housing and accommodation, and medical care totaled 136.6 billion yuan, up 96 percent from 2015.

These 'shares'-related industries have shown outstanding performance in the vehicle-sharing industry. From 2016 to 2018, China's vehicle sharing market has been surging. In 2015, transactions in the Chinese vehicle-sharing market stood at 370.6 billion yuan, compared with 559.3 billion yuan in 2016. The figure stood at 669.4 billion yuan in 2017, compared with 813.8 billion yuan in 2018. The car-sharing market holds a large position in China.

Second, accommodation sharing is the biggest growth area in China's shared economy. According to China's National Statistical Office, the number of households in China reached 1.08 in 2015. Therefore, there are numerous idle housing resources. To take advantage of these idle homes, lodging-sharing companies have received a lot of investment. Among them, Tujia and Piggy (Saojduanjou) received the most investment. In addition, Tujia purchased full ant short-term housing rents in 2016, enabling nearly five years of online short-term rental and building its own resources, channels and operational walls with the help of capital.

China has more than 10 cities and more than 2.3 million housing sources worldwide. People in China can check through Weibo or make safe payments such as Alipay. So far, Airbnb has been to provide home reservation services to overseas destinations, mainly for Chinese departures. At the same time, it is also providing home reservation services for foreign tourists coming to China. Chinese tourists, however, had little use in China's domestic market.

Currently, China has had a big impact on the pattern of competition in the industry by sharing pioneering areas such as economic development and large mergers and acquisitions in 2016. In the field of shared vehicles, in the area of merger and accommodation between Didi Travel and Uber China, Tujia acquired the ant short-term rental and apartment and bed-home businesses at Ctrip.com, Qunar.com and the business chain was expanded. The emergence of large-scale mergers and acquisitions symbolizes fast-growing accommodation sharing Despite the short time of the emerging economy, the development speed is fast and market dominance in the forefront of transportation, housing and living services has been completed early, creating an active shared atmosphere, stable user groups and sufficient market competition. This laid the foundation for the merger and acquisition of mature business models. Acquisition mergers and acquisitions in this field have emerged as a prelude to stability of competition patterns, the market structure from excessive dispersion to medium concentration, from competition to superior competition in a vicious cycle, competition from price-subsidized gold to experience improvement, and sharing of economic competition patterns for research and judgment.

I would like to add a suggestion on the development direction of China's shared economy. The shared economy has shifted from an early stage to a growth stage. First, China's shared economy is expected to maintain an average annual growth rate of more than 30 percent per year over the next five years, due to continuous acceleration of information technology innovation and applications, improving people's awareness levels and improving policies and regulations. The shared economy is expected to shift from an early stage to a growth stage. From the consumer sector to manufacturing, public services, society and life and other areas, product and service sharing areas are becoming increasingly extensive, and competition among platform companies will intensify, industry mergers and acquisitions will become more and more refined operations. The focus of competition will be shifted to improving the overall development quality of the shared economy. Second, shared economic development is expected to be increasingly standardized. In actively encouraging the sharing of economic development, the regulatory system has become a general trend of significant problems that directly affect the important interests of the public in particular. At the same time, the implementation of a multilateral collaboration governance system will be accelerated. The relevant departments are expected to actively innovate supervisory methods, using large amounts of data, cloud computing, artificial intelligence and other technologies, real-time visibility into the risks of platform enterprise market operations, funding management and user rights protection, and to innovate supervisory methods that enhance the ability to handle potential risks. Third, a shared economy is a typical credit economy with a unique characteristic of "missing" transactions among strangers. The rapid development of the shared economy has presented new requirements for social credit system construction, and by providing data and technical support for the establishment of the credit system, the two-way promotion of the economy and credit sharing system will be more prominent. The platform company can expect that a shared economy in China will be formed in the direction of guiding the use of large data technologies, user bi-directional assessments, third-party certifications, credit ratings and other means and mechanisms to improve relevant data.